Nonprofit body sets out recommendations for sports betting in New York

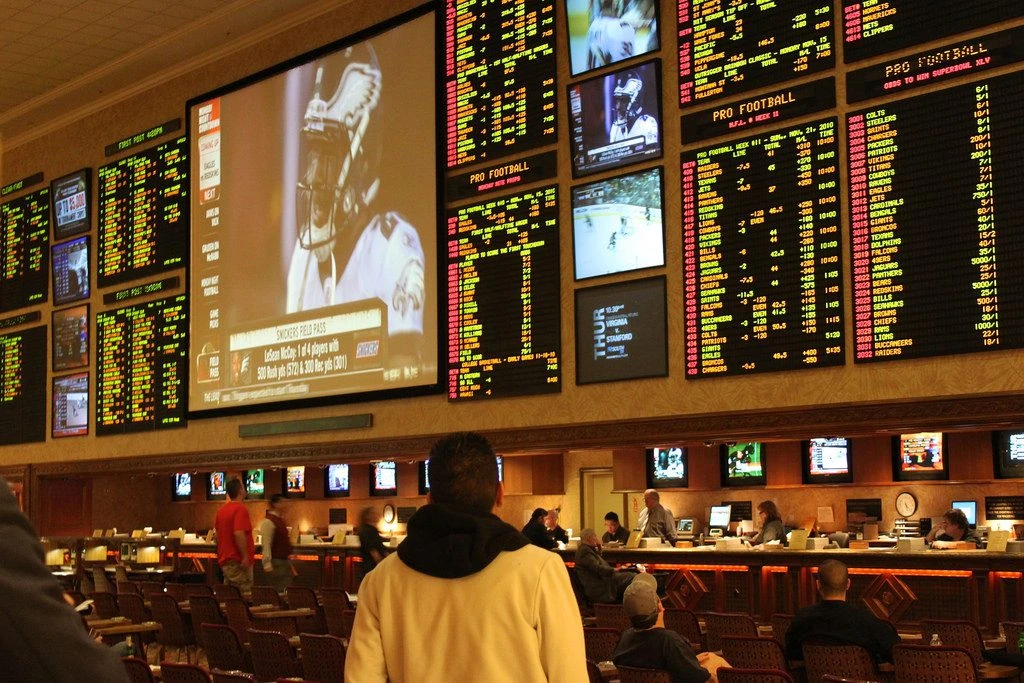

Legalising sports betting in New York would present an “economic opportunity” but state officials should bear in mind four key guidelines when deciding how to proceed, according to a report issued by the Citizens Budget Commission.

Described as a nonpartisan, nonprofit civic organisation whose mission is to achieve constructive change in the finances and services of New York City and New York State government, the CBC’s report, entitled ‘Hold Your Bets’, comes with New York one of a number of states on the cusp of joining Nevada, Delaware, New Jersey, Mississippi and West Virginia in fully legalising sports betting.

Following May’s Supreme Court ruling on PASPA, legislation that would have allowed for full-scale sports betting in New York failed to be passed before the end of the legislative session in June, but could be resumed in 2019.

In its report, the CBC said state leaders should consider its four guidelines as they decide whether and how to expand sports betting in New York. Firstly, the CBC said revenue estimates should be conservative citing the example of “overly optimistic” previous estimates on other types of gambling revenues.

In November 2013, New York State voters approved a constitutional amendment to expand casino gambling, with four commercial casinos subsequently opened. The CBC noted that for the state’s 2017-18 financial year, the casinos, with the exception of Resorts World Catskills which was not open until late in the year, generated gaming taxes of $112m (£86.6m/€96.2m) – far short of projections.

The CBC added: “Since sports betting has been illegal, it is difficult to predict how much of the illicit activity will transition to the legal market and how many new participants will engage. Furthermore, behaviour will vary from state to state or in areas within states based on demographic factors such as adult population, per capita disposable income, and ease of access to gaming markets.”

In its second piece of advice, the CBC noted that a competitive marketplace means that taxes should be designed “thoughtfully”. The report states that initial tax rates set in other states on gross gaming revenue (GGR) vary widely, adding that the economic impacts are uncertain.

New Jersey set its sports betting tax rates at 8.5% for land-based sports betting revenue, 13% for online wagering run by casinos, and an additional tax of 1.25% on gaming revenue received by racetracks. Meanwhile, in Delaware the state lottery oversees sports betting in a revenue sharing agreement, with the state receiving 50% of the remaining GGR after paying its sports betting contractor.

The CBC said: “Lower tax rates would arguably enable operators to spend more on marketing and customer service, invest more in technology, and potentially set odds that are more attractive to bettors. Conversely, setting higher GGR tax rates may result in fewer operators willing to enter the local marketplace, less investment in infrastructure and marketing, and less attractive odds. Ultimately this may result in fewer people transitioning from illegal to legal sports gambling.”

Thirdly, the CBC said state officials should consider sports betting’s potential impact on other gambling revenues. The report stated that the recently opened commercial casinos in upstate New York have also taken a large share of revenue from competitors. It added that sports betting could also impact other types of gambling including state run lotteries, which generate more than $3bn in revenue for education aid in New York State.

Finally, the CBC pointed to the issue of problem gambling, stating that gambling taxes are regressive, and increased gambling activity will impose social costs. The report said: “Taxes on GGR are regressive since low-income people bear an outsized burden, violating the principle of vertical equity in taxation.

“Expanding the opportunities for gambling in New York is likely to increase the prevalence of ‘problem’ gambling, which has been shown to be at its highest level in disadvantaged neighbourhoods and is associated with a range of behaviours, including crime, abuse, job loss, and bankruptcy, that impose social costs on others.”

However, the CBC also noted the potential benefits of legalised sports betting. Its report concluded: “In addition to revenues from taxing sports betting, there are potential economic benefits from job creation, including additional income and payroll, and sales taxes.

“Nationally, the estimated state and local benefit is estimated at $3.4bn, of which $254m is attributable to New York. Furthermore, the demand for illegal sports betting could decline as bettors shift to a legal alternative, generating law enforcement savings as the costs associated with investigation and prosecution of illegal activity decline.”

It was reported last month that New York could become the first state to regulate sports betting with a clause that would see a fee paid to professional sports leagues in the US.

States that have legalised sports betting in the wake of the Supreme Court ruling on PASPA have not included a fee as part of their regulations, despite calls from leagues to do so. Leagues have said this so-called ‘integrity fee’ would be used to combat issues related to cheating.

Peter Moschetti, a gaming commissioner in New York, said that lawmakers in the state are considering “all” components of a state senate bill introduced this year, including for 0.25% of wagers to go directly to professional and college sports leagues, as well as an 8.5% state tax on gross revenue generated from sports wagering.